Introduction

The S&P 500 has seen remarkable growth over the past decade, fueled by strong corporate earnings, accommodative monetary policies, and technological innovation. However, as we enter 2025, investors are questioning whether this bull market can sustain its momentum or if a correction is on the horizon. Several key factors, including Federal Reserve policies, corporate earnings, global macroeconomic trends, and geopolitical risks, will determine the trajectory of the S&P 500 in 2025.

Economic and Monetary Policy Outlook

One of the biggest drivers of stock market performance is the Federal Reserve’s monetary policy. In 2024, the Fed shifted to a more balanced approach, tapering quantitative easing while gradually raising interest rates to curb inflation. As of early 2025, inflation remains a critical concern, but recent data suggests that it is stabilizing.

- Interest Rates: The Fed’s stance on interest rates will be a major determinant of equity market performance. If inflation remains under control, the Fed might pause rate hikes, which could support stock valuations. However, if inflation persists above 3%, the Fed may adopt a more aggressive tightening policy, potentially dampening market enthusiasm.

- Liquidity and Market Conditions: With quantitative tightening in effect, market liquidity has tightened compared to the ultra-loose policies of the early 2020s. This could put pressure on growth stocks, which thrive in low-rate environments, while favoring value stocks with strong cash flows.

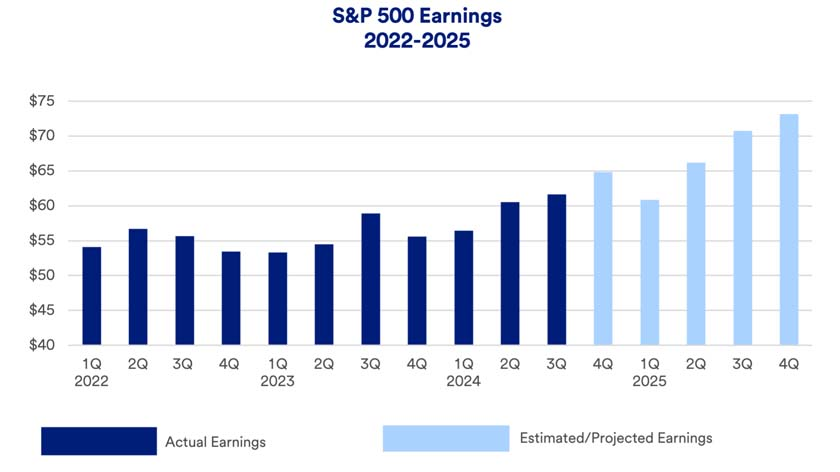

Corporate Earnings and Sector Performance

The S&P 500’s ability to continue its uptrend depends heavily on corporate earnings growth.

- Technology and AI Boom: The tech sector, which makes up a significant portion of the S&P 500, is expected to continue benefiting from advancements in artificial intelligence (AI), cloud computing, and automation. Companies like Apple, Microsoft, and NVIDIA are projected to post strong earnings in 2025.

- Healthcare and Biotech: The healthcare sector remains resilient, with strong innovation in gene therapy and personalized medicine driving growth.

- Energy Sector: With a continued transition towards clean energy, renewables and EV-related industries could experience further expansion, while traditional oil and gas companies may face headwinds from regulatory changes.

Potential Risks and Challenges

Despite the optimistic outlook, several factors could trigger a correction in 2025:

- Recession Fears: If economic growth slows significantly, corporate earnings could decline, triggering a market pullback.

- Geopolitical Tensions: Rising tensions between global powers such as the U.S. and China or instability in the Middle East could create volatility in global markets.

- Market Valuations: The S&P 500 is trading at historically high valuations. If earnings do not meet expectations, we could see a downward adjustment in stock prices.

Conclusion

While the S&P 500 has strong fundamentals backing its continued growth, the risk of a correction cannot be ignored. Investors should maintain a balanced approach, diversifying across sectors and asset classes to mitigate risks. Monitoring inflation, interest rates, and earnings reports will be key to navigating the market in 2025. Whether the S&P 500 continues its uptrend or faces a correction will largely depend on how these macroeconomic factors evolve in the coming months.

Leave a Reply