The Federal Reserve’s interest rate policies play a crucial role in shaping the performance of financial markets. In 2025, investors are closely monitoring the Fed’s decisions to determine their impact on Wall Street. With inflation concerns, economic growth trends, and geopolitical uncertainties in play, the Fed’s monetary policy stance is a critical factor influencing stock prices, bond yields, and overall market sentiment.

The Fed’s Current Stance on Interest Rates

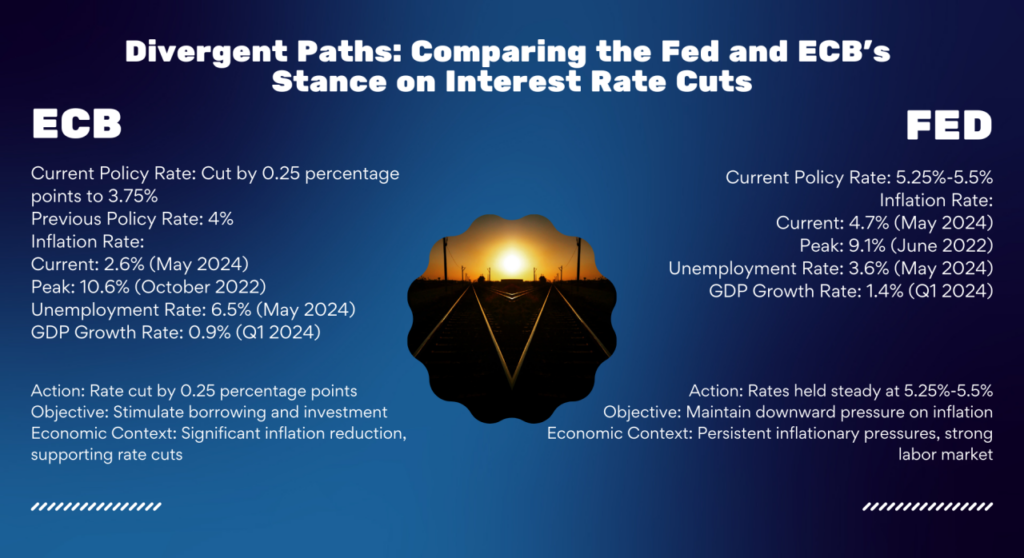

The Federal Reserve has adopted a data-driven approach to setting interest rates, balancing the need to control inflation while supporting economic growth. In 2025, the Fed is evaluating factors such as:

- Inflation trends: Persistent or moderating inflation levels affect the likelihood of rate hikes or cuts.

- Labor market conditions: Strong employment data may support a tighter monetary policy, while weakness may lead to easing.

- Global economic environment: International market stability and central bank policies in other countries influence the Fed’s decisions.

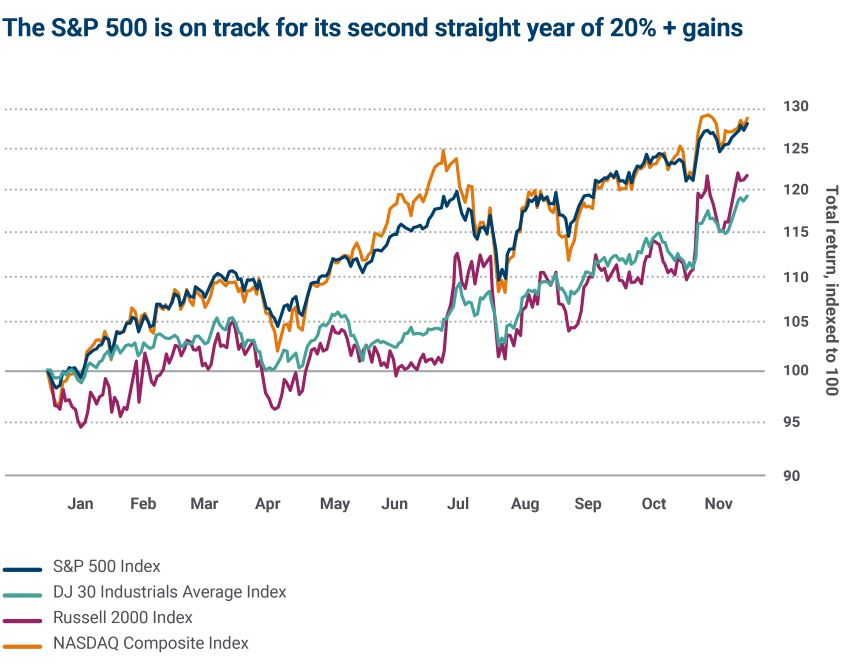

Impact on Stock Market Performance

The Fed’s rate decisions directly influence stock market behavior in the following ways:

- Growth vs. Value Stocks: Higher interest rates typically benefit value stocks (e.g., banking, energy) while putting pressure on high-growth technology stocks.

- Corporate Borrowing Costs: Rising interest rates increase borrowing costs for businesses, potentially slowing expansion and reducing corporate profits.

- Market Volatility: Speculation around the Fed’s future moves leads to short-term market swings, influencing investor sentiment.

The Effect on Bond Markets

Bond markets are highly sensitive to interest rate changes. Key implications include:

- Treasury Yields: As the Fed raises rates, yields on government bonds tend to increase, making them more attractive to investors.

- Corporate Bonds: Higher rates lead to increased yields on corporate bonds, affecting company financing strategies.

- Inflation-Protected Securities: TIPS (Treasury Inflation-Protected Securities) may see increased demand in an inflationary environment.

Investor Strategies in a Rising Rate Environment

Given the Fed’s current trajectory, investors may consider:

- Diversifying portfolios: A mix of stocks, bonds, and commodities can help mitigate risk.

- Focusing on dividend-paying stocks: Companies with strong balance sheets and consistent dividends may offer stability.

- Exploring alternative investments: Real estate, commodities, and cryptocurrencies may serve as hedges against market fluctuations.

Conclusion

The Federal Reserve’s interest rate policies remain a key driver of Wall Street’s performance in 2025. Investors should stay informed about macroeconomic trends, adjust their portfolios accordingly, and be prepared for potential market volatility. Understanding how monetary policy affects different asset classes will be essential for navigating the financial markets in the coming year.

Leave a Reply